Thomas Cook (India) Limited delivers Record Operating Profits for FY23 Driven by Robust Recovery across business segments

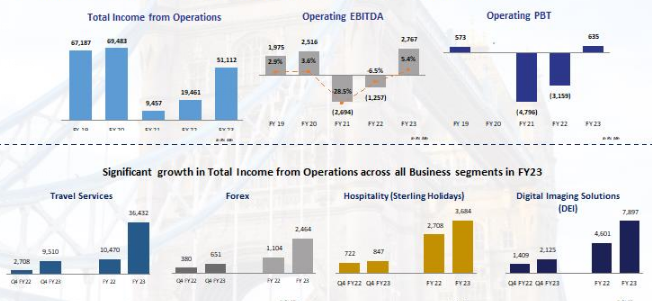

Highlights for FY23 The Group’s Operating EBITDA grew significantly to Rs. 2.7Bn for FY23 against a loss of Rs. 1.2 Bn in FY22. Growth driven by Foreign Exchange & Travel Businesses (Thomas Cook); Hospitality (Sterling Holidays) Highest

Highlights for FY23

- The Group’s Operating EBITDA grew significantly to Rs. 2.7Bn for FY23 against a loss of Rs. 1.2 Bn in FY22. Growth driven by Foreign Exchange & Travel Businesses (Thomas Cook); Hospitality (Sterling Holidays)

- Highest Operating EBITDA &Operating PBT for Thomas Cook in a decade. Operating EBITDA at Rs. 1.2 Bn for FY23; Operating PBT at Rs. 560 Mn Vs a loss of Rs. 1.14 Bn in FY22

- Sterling Holidays registeredHighest EBITDA & PBT since inception: EBITDA at Rs 1.1 Bn for FY23; PBT at Rs. 659 Mn Vs Rs. 436 Mn in FY22

- Consolidated Total Income from Operations grew YoY by 163% in FY23 to Rs. 51 Bn

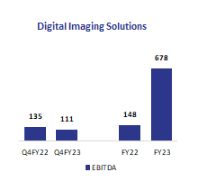

- Robust growth across all business segments in FY23; Income from operations growth (YoY): Forex: 123%, Travel: 248%, Hospitality (Sterling Holidays): 36%, Digital Imaging Solutions (DEI): 72%

- Focus on Cost Optimization saw annualized savings of Rs.3.71 Bn for FY23, representing a 20% reduction in costs Vs FY20 (PrePandemic). The Group maintains a strong financial position, with Cash & Bank balances of Rs. 10.1 Bn as of March 31, 2023

Highlights for Q4 FY23

- The Group’s Operating EBITDA at Rs. 518 Mn Vs Rs.239 Mn in FY22

- Standalone Operating EBITDA for TCIL at Rs. 205 Mn Vs Rs. 28 Mn for Q4 FY22

- For Q4FY23 Consolidated Total Income from Operations grew by 150% YoY to Rs. 13.2 Bn

Travel Services

- Leisure Travel: Sales growth of 235% YoY; recovery of 42% vs.pre pandemic levels

- MICE: managed over 600 groups; 23 events for G20 Summit; 20,500 customers for Khelo India

- Corporate Travel turnover grew by 213% YoY; acquired 57 accounts

- Travel Corporation (India) Limited: Recovery of 53% in turnover for FY23 Vs prepandemic

- All overseas DMS units registered significant trading volumes for the year

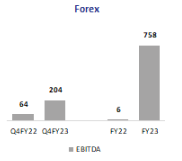

Forex

- Retail growth: 81% YoY; Recovery 97% Vs pre pandemic

- Overseas Education: 162% YoY; 38% growth Vs pre pandemic

- Enabled UPI transactions for foreign nationals from G20 nations in collaboration with Pine Labs & NPCI

- New prepaid card issuance: up by 228% YoY; 29% Vs pre pandemic

- Card loads grew by 172% YoY

- Launched FX Now: Corporate booking tool and B2C mobile app

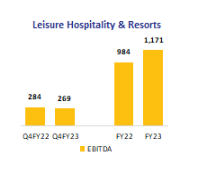

Hospitality(Sterling Holidays)

- 9th consecutive profitable quarter

- Highest revenue recorded: Rs 3.6 Bn (36% growth Vs pre pandemic)

- Annualised Growth Vs prepandemic: 39% growth in ARR; 55% growth in F&B spend

- FY23: 184 Rooms added; 6 Resorts

- Guest ratio increased to 62% Vs 47% (prepandemic), increasing topline growth

Digital Imaging Solutions (DEI)

- FY23saw the addition of 28new partnerships

- Renewal of 34existing collaborations

- Operational launch of8key projects and introduction of own B2C attraction

- Commenced operations at 8 key attractions

- Selected as imaging partner for Festive Events in the UAE

* The company’s performance as reported in the SEBI results format will differ as the underlying Operating Performance has been calculated after adjusting for the impact of Rs.353 Mn for FY23 and Rs. 40 Mn for FY22. as a result of the Mark to Market, non-cash, non-operational loss arising from the shares in Quess Corp Limited, held by its Employee Benefit Trust.

“I am delighted to share the strong results for FY23 for the Group, with a record Operating EBITDA at Rs. 2.7BnVs a loss of Rs. 1.2 Bn in FY22. Total Income from Operations also grew annually by 163% in FY23 to Rs 51 Bn. This commendable performance, was led by Thomas Cook India – registering its highest Operating EBITDA & Operating PBT in a decade & Sterling Holidays – recording its highest EBITDA & PBT since the company’s inception.

Our focus through the year has been on drivingtrading volumes, margin expansion, improved productivity via digital solutions and effective cost optimizationmeasuresto achieve this. Given the strong forward booking funnels, across business segments& geographies, we are confident of a strong performance in the coming quarters as well.”

Mr. Madhavan Menon, Chairman and Managing Director, Thomas Cook (India) Limited

Business Segment-wise Performance:

- Foreign Exchange

- Strong Retail growth: 81% YoY; recovery 97% Vs pre pandemic

- Overseas education segment at 162% YoY; growth 38% Vs pre pandemic

- On-boarded 572 new B2B partners for FX Mate in FY23

- Launched FX Now – Corporate booking tool and B2C mobile app offering a suite of Foreign Exchange services to customers on the go

- Enabled UPI transactions for foreign nationals from G20 nations in collaboration with Pine Labs and NPCI – at all airport counters and retail outlets pan India

- New prepaid card issuance up by 228% YoY; growth of 29% Vs pre pandemic

- Card loads grew by 172% YoY

2. Hospitality (SterlingHolidays)

- 9th consecutive profitable quarter

- 19% growth in EBITDA for FY23 Vs FY22; 6x growth Vs pre pandemic

- On a YoY basis: 39% growth in ARR; 55% growth in F&B spends

- Occupancy was at 58% for Q4 FY23

- Guest ratio to members grew by 62% Vs 47% prepandemic;59% YoYgiving an upside on revenues

- Resort revenues increased by 70% Vs prepandemic; 43% YoY

- Expanded and scaled distribution of resort inventory and room rates using Sterling One platform that added significant volumes to existing business

- New resorts launched in Q4 FY23: Chailand Haridwar

- Accelerated focus on digitalisation: Sterling One platform for bookings on the go, Robotic automation tool, bots facilitating efficiencies at an operating level, Cloud based PMS

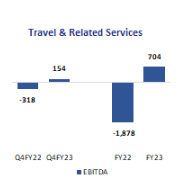

3. TravelServices

- Corporate Travel

- FY23: Travel turnover grew by 213% YoY; surpassing pre pandemic levels for the quarter

- Acquisition of 57 new accounts across sectors like Engineering, IT/ITS, Manufacturing, Media-Entertainment, Telecommunications, Automobiles, Banking & Finance, Consulting, Oil & Gas, Infrastructure, etc.

- Over 50% adoption by clients on the corporate self-booking tool

- Meetings-Incentives-Conferences-Exhibitions (MICE)

- FY23: Significant growth of 711% YoY; 85% recovery Vs pre pandemic

- Managed over 600 groups – including sizeable movements of between 100 to 3000 delegates

- Empaneled as event partner for the G20 Summit; 23 events managed across 20 cities

- Handled 20,500 customers for Khelo India 2023; managed Digital Yoga Exhibition for Govt. of India; event for ground breaking ceremony for world’s first World Health Organization (WHO) Global Centre for Traditional Medicine

- Sporting Events: multiple corporate groups for T20 World Cup and FIFA World Cup 2022

- Several Inbound groups and event in NCR and Mumbai – 6700 delegates from over 130 countries

- Leisure Travel

- FY23: Marked improvement in sales with 235% YoY growth; recovery of 42% Vs pre pandemic levels

- Launched new chatbot backed by ChatGPT

- Readymade Holidays designed for new age travellers seeking experiences, with immediate end-to-end fulfillment

- With the fall in average age of customers, launched a new campaign focusing on Gen Z

- Strong focus on Domestic Tourism – including spiritual tourism, outdoor-adventure trips, etc.

- Introduced Easy Visa Holidays to short haul outbound destinations to counter visa challenges for long haul

- Introduced new destinations like Greenland, Vietnam, Iceland, etc.

- Destination Management Services Network

- India – Travel Corporation (India) Limited: Recovery of 53% in turnover for FY23 Vs pre pandemic. The top 5 markets for the quarter were UK, France, Russia, Germany and USA contributing 61% of the overall business

- o Middle East – Desert Adventures saw significantly higher volumes during the year as compared to previous year primarily driven by CIS countries, OTA business, LATAM and India markets. MICE has also shown healthy volumes during the year Forward pipeline is robust with the expectation of surpassing pre pandemic levels in FY24 Sita’s 60th anniversary celebrated across the office network with the launch of Travart (new digital future ready platform) on March 23, 2023

- Private Safaris:

- East Africa – Healthy sales throughout the year supported by good volumes from traditional markets such as Germany, US, UK, France. Decent volumes were also seen from France, Romania and India. Due to strong financial performance, the entity repaid the entire outstanding balance of its parent loans which were taken for supporting operations during the pandemic

- o South Africa – Key European markets saw volumes gradually increase during the year which resulted in significantly better performance as compared to previous year

- USA – Allied TPro: Volumes during the year were driven by European market and FIT. Entered into a 50:50 joint venture agreement with New World Travel, Inc. in December quarter. The new JV company, Allied New World, was set up to leverage the strengths of both companies to drive productivity and accelerate growth in the post pandemic era

- Asia Pacific – Asian Trails: Sales saw an uptick during the year due to re-opening of key destinations viz. Thailand, Indonesia, Vietnam, Malaysia, Singapore and Cambodia. Gradual increase in sales has resulted in a decent recovery from pre pandemic level especially in last quarter

4. Digital Imaging Solutions (DEI)

- During the year, DEI signed 28 new agreements across various geographies viz. Middle East, India, USA, South East Asia etc. Notable new partnerships were Snow Oman, Sheikh Zayed Grand Mosque, LEGOLAND Malaysia, Trans Snow World Surabaya in Indonesia, Snow Kingdom Hyderabad in India, Museum of Science & Industry, Chicago USA, etc.

- Key partnership renewals were Mandai Wildlife Reserve in Singapore, Mövenpick Resort Kuredhivaru in the Maldives and Wild Wadi Waterpark, UAE

- DEI was the imaging partner for many festive events in UAE, noteworthy being Dubai Festive City Market, Souq Madinat Festive Market, Caesar’s Palace Christmas Brunch, Jumeirah Beach Hotel Christmas Brunch, Atlantis Dubai New Year’s Eve Gala, Madinat Jumeirah’s New Year’s Eve Gala, Jumeirah Beach Hotel New Year’s Eve Gala and Burj Al Arab New Year’s Eve Gala

- In a notable milestone, DEI has launched its first-ever B2C attraction – The Dubai Balloon

Other Key Business Updates

- Focus on Digitalization

The Group’s Digital First strategy saw sustained momentum during Q4FY23

- Launch of FX Now, a new gen corporate booking tool and a dedicated B2C mobile-app that offers a suite of Foreign Exchange services onthego. Empowers customers with convenient, customizable and contactless end-to-end foreign exchange solutions

- Integration of the Group’s DMS companies (Asian Trails and Desert Adventures) on thomascook.in; real-time updates via live feed will enable customers to avail best pricing for hotels in the Middle East and South East Asian destinations

- Chatbot functionality has been enhanced to ensure seamless sales process- with a Plan Your Holiday for both Domestic & International trips. Increased usage of 70% MoM

Strong focus in FY23 saw delivery across business lines:

- Launch of automated systems for MICE: sales operation application- “MANTRA” and vendor management – NEWGEN

- Launch of innovative Live Video Connect platform via the Companies’ holiday campaigns – where customers can seamlessly connect with holiday experts via a video call/chat, without having to download any added apps or software

- Introduced Holiday Mate – an online B2B tool to empower travel agent partners to deliver swift, seamless and accurate services to the end consumer

- Enhanced self-service features for holiday bookings on the website and Mobile App

- India Network Expansion

- Leisure Travel:26 franchise outlets opened in New Delhi, Karnataka, Hyderabad, Goa, Gujarat, Maharashtra, Kolkata, Punjab, Tamil Nadu, Uttar Pradesh and an owned branch in Mumbai

- Foreign Exchange:Franchise outlet opened in Agra; new counter inaugurated at Delhi International Airport; Cochin International Airport agreement extended for 5 years

- Awards and Partnerships

For Q4 FY23

- Thomas Cook India partnered with Pine Labs to enable UPI payments for foreign nationals from G20 nations

- Thomas Cook India & SOTC Travel partnered with LTIMindtree to launch ‘Green Carpet’ – a global platform for Enterprises to monitor & manage business travel emissions

- Thomas Cook & SOTC’s partnership with Vistara Getaways was extended to include Club Vistara Frequent Flyer Program benefits

- Thomas Cook India & SOTC Travel won Best Outbound & Domestic Tour Operator of the Year Awards at SATTE 2023

- SOTC Travel won Best Outbound Travel Operator and Best MICE Travel Operator at The Economic Times Travel & Tourism Annual Awards

FY23

- Thomas Cook India inked a long-term agreement with KrisFlyer – the loyalty programme of Singapore Airlines for its Forex business

- Thomas Cook India & SOTC signed an agreement with Turkiye Tourism to boost demand and visitations for the destination

- Thomas Cook India & SOTC extended their exclusive partnership with Vistara to launch Vistara Getaways – International

- Thomas Cook India, Mastercard & HDFC Bank collaborated for offers on S. E. Asia Holidays

- Thomas Cook India Group won the CNBC-ICICI Lombard Risk Management Award for the 5th time

- Thomas Cook India & SOTC inked an MOU with Saudi Tourism Authority

- Thomas Cook India sustained its strategic partnership with Maldives Marketing and Public Relations Corporation (MMPRC)

About Thomas Cook (India) Limited:

Set up in 1881, Thomas Cook (India) Limited. (TCIL) is the leading omnichannel travel company in the country offering a broad spectrum of services including Foreign Exchange, Corporate Travel, MICE, Leisure Travel, Value Added Services and Visa Services. It operates leading B2C and B2B brands including Thomas Cook, SOTC, TCI, SITA, Asian Trails, Allied TPro, Australian Tours Management, Desert Adventures, Travel Circle International Limited (TCI 勝景), Sterling Holiday Resorts Limited, Distant Frontiers, TC Tours, Digiphoto Entertainment Imaging (DEI), Go Vacation, Private Safaris East & South Africa

As one of the largest travel service provider networks headquartered in the Asia-Pacific region, The Thomas Cook India Group spans 28 countries across 5 continents

TCIL has been felicitated with The Outbound Tour Operator of the Year 2022 & 2019 at the SATTE Awards, IAMAI India Digital Awards 2022, CNBC-TV18 & ICICI Lombard India Risk Management Award – Travel & Leisure Category 2022 & 2021, CIO100 Award for digital innovation 2022, ‘Innovation in Omni-experience’ Award at International Data Corporation’s (IDC) Industry Innovation Awards 2021, The Best Travel Agency – India at TTG Travel Awards 2019, The Best Outbound Tour Operator at the Times Travel Awards 2019 & 2018, Silver award for Asia’s Best Integrated Report (First Time) category at the Asia Sustainability Reporting Awards 2019-2021, Best Risk Management-Framework & Systems at the India Risk Management Awards 2019; The French Ambassador’s Award for Exemplary Achievements in Visa Issuance 5 years in a row and the Condé Nast Traveller – Readers’ Travel Awards from 2011 to 2019.

CRISIL has reaffirmed the rating on debt programmes and bank facilities of Thomas Cook (India) Limited – ‘CRISIL A+/Negative on the long-term bank facilities of TCIL and CRISIL A1 rating on the short-term bank facilities and short- term debt of the Company. For more information, please visit www.thomascook.in

Fairbridge Capital (Mauritius) Limited, a subsidiary of Fairfax Financial Holdings Limited promotes TCIL by holding 72.34% of its paid-up capital and is responsible for the execution of acquisition and investment opportunities.

—-

English

English French

French German

German Italian

Italian