Mahindra Holidays & Resorts India Ltd-Highest-ever Consolidated Income of Rs 2,810 Crs & EBITDA of Rs 623 Crs in FY24

Highest-ever Annual Performance in FY24 at Standalone level, excl. one-offs¹ Total Income at Rs. 1,424 Crs (+12% YoY) EBITDA at Rs. 406 Crs (+15% YoY) PBT at Rs. 213 Crs (+16 % YoY) PAT at Rs. 158 Crs (+16%

Highest-ever Annual Performance in FY24 at Standalone level, excl. one-offs¹

- Total Income at Rs. 1,424 Crs (+12% YoY)

- EBITDA at Rs. 406 Crs (+15% YoY)

- PBT at Rs. 213 Crs (+16 % YoY)

- PAT at Rs. 158 Crs (+16% YoY)

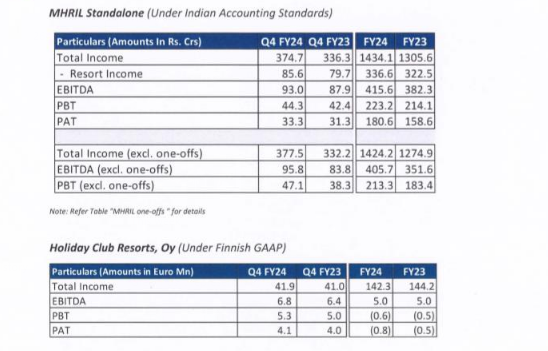

Holiday Club Resorts Oy delivers operating profit of € 6.8 Mn in Q4 and € 5.0 Mn in FY24.

Highest-ever Consolidated Income of Rs 2,810 Crs & EBITDA of Rs 623 Crs in FY24, excl. one-offs

Mumbai, 26th April 2024 : Mahindra Holidays & Resorts India Ltd. (‘Company’), India’s leading leisure hospitality provider, reported its standalone and consolidated financials for the fourth quarter and financial year ending 31st March 2024.

Operational Highlights (Standalone)

Member Additions

Q4 FY24 FY24

- Member additions at 5,734 (+12% YoY).

- Membership Sales Value2 at Rs. 243 Crs (+18% YoY).

- Highest ever Quarterly Upgrades at Rs. 66 Crs (+18% YoY).

- Robust Member additions at 20,019 (+15% YoY).

- Highest ever Membership Sales Value? at Rs.824 Crs (+16% YoY). •

- Highest ever Upgrades at Rs. 218 Crs (+16% YoY).

FY24

- Robust Member additions at 20,019 (+15% YoY).

- Highest ever Membership Sales Value2 at Rs.824 Crs (+16% YoY).

- Highest ever Upgrades at Rs. 218 Crs (+16% YoY).

- Cumulative member base stands at 2,97,771 with 85% fully paid.

Resorts/Room Inventory

Q4 FY24

High resort occupancy at 87.3% vs 85% in Q4 FY23

New resorts at domestic destinations such as Pelling (Sikkim), Kaziranga (Assam), and international destinations such as Istanbul (Turkey), Nairobi (Kenya), Hua Hin & Khao Lak (Thailand), Tbilisi (Georgia)

FY24

- Resort occupancy at 85%

- Inventory addition of 387 keys, leading to an inventory base of 5,327 keys

- Overall capex of “Rs 835 Crs (5 projects/ 690 keys) underway : 2 Greenfield Commenced, 1 Acquisition & 1 Expansion completed, & 1 ongoing expansion of an existing resort

Standalone Financial Highlights-

Q4 FY24 (excluding one-offs’)

- Highest ever Q4

- Total Income at Rs. 378 Crs (+14% YoY)

- EBITDA at Rs. 96 Crs (+14% YoY); EBITDA Margin at 25.4% (+20 bps YoY)

- PBT at Rs. 47 Crs (+23% YoY); PBT Margin at 12.5% (+100 bps YoY)

- PAT at Rs. 35 Crs (+25% YoY) ; PAT Margin at 9.4 % ( +90 bps YoY)

- Resort Income at Rs. 86 Crs

FY24 (excluding one-offs’)

- Highest ever

- Total Income at Rs. 1,424 Crs (+12% YoY)

- EBITDA at Rs. 406 Crs (+15% YoY); EBITDA Margin at 28.5% (+90 bps YoY)

- PBT at Rs. 213 Crs (+16% YoY); PBT Margin at 15% (+ 60 bps YoY)

- PAT at Rs. 158 Crs (+16 % YoY) ; PAT Margin at 11.1 % (+ 50 bps YoY)

- Resort Income at Rs. 337 Crs

- Deferred Revenue stands at Rs. 5,595 Crs (up by Rs. 269 Crs YoY)

- Cash position at Rs. 1,383 Crs as on 31 March 24. Income Tax Refund received of Rs 66 Crs. (includes interest of Rs 6.5 Crs)

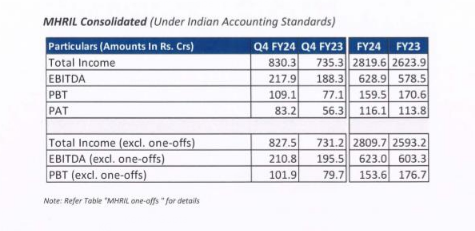

Consolidated Financial Highlights

Q4 FY24 (excluding one-offs’)

- Highest ever

- Total Income at Rs. 828 Crs (+13% YoY).

- EBITDA at Rs. 211 Crs (+8% YoY) PBT at Rs. 102 Crs (+28% YoY);

- PBT Margin at 12.3% (+140 bps YoY)

FY24 (excluding one-offs’)

- Highest ever Total Income at Rs. 2,810 Crs

- Highest ever EBITDA at Rs. 623 Crs

- PBT at Rs. 154 Crs

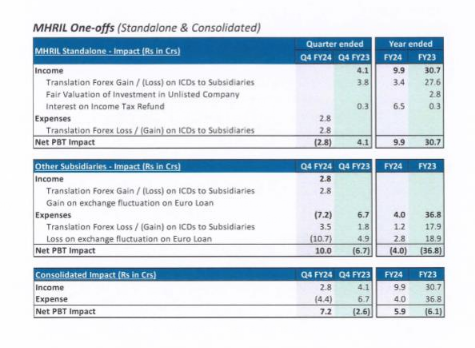

Note : 1. Refer Table “MHRL one-offs “for details

“We have achieved exceptional results in FY24 with highest ever Total Income, Resort Income, EBITDA, PBT & PAT along with improved profit margins on YoY basis. Our consistent delivery of immersive family vacation experiences helped us cross a significant milestone of adding 20,000 members and reach a cumulative member base of 2.98 Lakhs. We have also accelerated our inventory additions & have expanded the inventory base by 387 keys to 5327 keys.”-Kavinder Singh, Managing Director and Chief Executive Officer, Mahindra Holidays & Resorts India Ltd

“Holiday Club Resorts (HCR), our European Subsidiary, has delivered robust Q4 performance, achieving an operating profit of €6.8 Mn in Q4 leading to a full-year operating profit of € 5.0 Mn, despite the adverse macroeconomic situation.

Further highlighting Consolidated FY24 performance, he elaborated, Overall, Total Income & Operating profit, excluding one-offs, is the highest ever in our history.”Kavinder Singh, Managing Director and Chief Executive Officer, Mahindra Holidays & Resorts India Ltd

About Mahindra Holidays & Resorts India Limited

Mahindra Holidays & Resorts India Limited (MHRIL) India’s leading leisure hospitality company offers quality family holidays primarily through vacation ownership. MHRIL offers a 25-year membership along with other products – Bliss, Go Zest, Club Mahindra Fundays for corporates, through its flagship brand Club Mahindra. As on March 31, 2024, MHRIL has 110 resorts across India & abroad and its subsidiary, Holiday Club Resorts Oy (HCR), Finland, a leading vacation ownership company in Europe has 33 Timeshare Properties (Including 9 Spa Resorts) across Finland, Sweden, and Spain.

Visit us at www.clubmahindra.com

—-

English

English French

French German

German Italian

Italian