Investments into Indian hospitality to exceed USD 2.3 bn over the next 2-5 years

12,000 hotel rooms likely to be added in 2023; no. of hotel rooms to grow at an expected CAGR of ~3.3% by 2025 Total investment during 2020-2023 to exceed USD 0.4 bn National – 17 May 2023

- 12,000 hotel rooms likely to be added in 2023; no. of hotel rooms to grow at an expected CAGR of ~3.3% by 2025

- Total investment during 2020-2023 to exceed USD 0.4 bn

National – 17 May 2023 – CBRE South Asia Pvt. Ltd., India’s leading real estate consulting firm, today announced the findings of its first-ever hospitality report, ‘Indian Hospitality Sector: On a Comeback Trail’. The report highlights the occupancy trends and growth in the hospitality sector in India.

The report points out that the outlook for the sector improved after a strong vaccination programme, reopening of borders, removal of travel restrictions, and sustained economic growth put the hospitality sector on a recovery path. A total of over USD 2.3 bn in investments are expected over the next 2 – 5 years, and more than USD 0.4 bn of investment is expected during 2020-2023 period. The report also states that ~12,000 rooms are likely to be added in 2023, and the number of rooms is expected to grow at a CAGR of ~3.3% by 2025. It is estimated that a recovery in demand will remain ahead of supply addition, which will augur well for the key metrics of the hotel sector’s performance. Demand over the next few years is likely to be more equilateral and broad-based rather than being centered across only select cities/markets. CBRE expects this steady supply growth to continue for the next few years.

Increasing investor interest has been one of the significant drivers of growth for the Indian hospitality space in the past couple of years. In addition, Indian companies are also participating actively in this segment by way of investing or expanding their presence. The international presence and acceptance of Indian chains have established the service level and visibility of these brands.

| Key deals in India’s hospitality segment between 2020 and 2023 | |||

| Investor | Investee | Year | Details |

| Kotak Realty Fund | The Lalit’s Bharat Hotels | 2023 | Kotak Realty Fund has invested more than INR 1,100 crore in Bharat hotels, the owner of Lalit Hotels that operates luxury hotels, resorts, and palaces in the country. |

| Jujhar Group | Fairfield by Marriott Hotel | 2022 | Jujhar Group has entered the hospitality space by acquiring the Fairfield by Marriott Hotel located in Amritsar. |

| IQI India | Signum Hotels & Resorts | 2021 | IQI India and Signum Hotels have formed a joint venture and plan to invest USD 150 million over the next two to five years in developing hotel properties across the nation and the world. |

| Oberoi Realty | Sahana Group’s upcoming five-star hotel | 2020 | Evenstar Hotels (a wholly owned subsidiary of Oberoi Realty) has acquired a 50% stake in Sahana group’s upcoming five-star luxury hotel in Worli, Mumbai for INR 1,040 crore. |

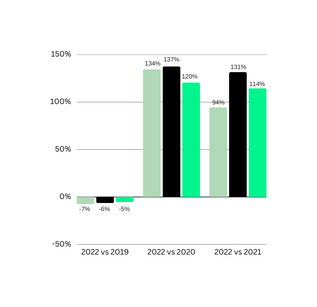

Further, the report states that all industry KPIs such as percentage of rooms occupied / occupancy rate; average daily rate (ADR) / average rental revenue per occupied room at a given time; and revenue per available room (RevPAR) / revenue generated by one room are expected to surpass pre-pandemic levels this year. RevPAR witnessed 94% growth in India in 2022 as compared to 2021. According to the report, in 2022, the hotel sector in India saw renewed footfalls and a steady rise in revenue, indicating a smooth recovery from the pandemic.

Change in RevPAR (2019-2022)

Source: CBRE Research Q2 2023 / STR Global

Key hotel metrics in 2022

| Location | Occupancy Rate (%) | ADR (USD) | RevPAR (USD) | |

| India | 60.5 | 73.66 | 45.09 | |

| Mumbai | 73.4 | 100.00 | 74.76 | |

| New Delhi | 67.3 | 82.00 | 56.37 | |

“In recent years, several international hotel chains have made significant investments in the country, looking to tap into the growing demand for hospitality services. Several PE funds have also invested in domestic and international hospitality operators looking to expand their footprint in the country. The sector has also benefited from the government’s continued focus on reforms, as a result, the government expects the country’s tourism and hospitality sector to earn USD 50.9 billion as visitor exports by 2028.”

Anshuman Magazine, Chairman & CEO – India, South-East Asia, Middle East & Africa, CBRE,

“The tapering of COVID-19 restrictions, pent-up demand, and India’s relative affordability to other leading global destinations have led to a steady growth in demand for the hospitality sector after an almost two-year slowdown.Growing popularity of ‘bleisure’ (business + leisure) travel as well as renewed focus on domestic, medical and religious tourism, has given us a glimpse of what the future holds for this sector. Further, COVID-19 has introduced sweeping changes in the operational aspects, thereby providing the hospitality sector room for evolution”.

Rami Kaushal, Managing Director, Consulting & Valuation Services, India, Middle East & Africa, CBRE

New demand drivers spurring growth in the sector

- Renewed focus on domestic tourism

- Domestic visitor spending across India in 2021 stood at about USD 151 billion, a sharp rise from the previous year, which was hit by the onset of the COVID-19 pandemic and subsequent lockdowns. India also ranked fourth worldwide in terms of domestic travel and tourism expenditure that year.

- Infrastructure initiatives such as the launch of indigenous semi-high-speed trains, Vande Bharat Express, have also given a fillip to domestic tourism.

- Growing popularity of combining business with leisure travel (bleisure) post-COVID-19

- Often, executives now combine business with leisure trips – giving rise to ‘bleisure’ travel and ‘workcations’

- As a result, business hotels are expanding their array of services by including tour packages and pre-planned itineraries for the partners/families of the business traveller as well as wellness breaks in the form of jungle safaris and stargazing setups

- Further, homestays, which have historically been favoured by leisure travellers, are offering business services such as workspace furniture, Wi-Fi connectivity and play areas for children

- Changing face of religious tourism to alter the type of hospitality demand

- Religious tourism has always been a steady income generator for this sector

- Leading chains have already started to tap into the changing aspirations of religious tourists, most of who now seek clean, hygienic, and family-friendly accommodations for which they are ready to pay a premium

- Continued popularity of India as a medical tourist destination

- Some of the factors that are driving the country’s medical tourism is its state-of-the-art healthcare infrastructure, lower waiting time and capability to deliver world-class care at 30-35% lower cost than other countries

OUTLOOK

- Technology as a macro trend has already begun to permeate this segment. It is currently operating at two levels – digitalization of the guest experience by way of automated hotel processes for activities such as check-in/check-out; and digitalization of background processes for jobs such as hotel management and room bookings.

- Currently, ownership and management contracts are a more popular business model in India. However, as the country’s hotel market matures, brands are now considering deploying the franchising business model in India. Several international and Indian-origin brands are now exploring opportunities in franchising across positioning and brands. This trend accelerated in the aftermath of COVID-19 in India after travellers sought trusted brands as they started travelling again after almost two years.

- ESG has become a buzzword across businesses globally. Sustainable tourism is gaining traction as tourists become more conscious of the climate crisis, thus requiring hospitality players to embark on ESG journeys. Moreover, prominent hotel chains are now focusing on the S (social) and G (governance), in addition to the E (environmental) elements.

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE: CBRE), a Fortune 500 and S&P 500 company headquartered in Dallas, is the world’s largest commercial real estate services and investment firm (based on 2022 revenue). The company has approximately 115,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries. CBRE serves a diverse range of clients with an integrated suite of services, including facilities, transaction and project management; property management; investment management; appraisal and valuation; property leasing; strategic consulting; property sales; mortgage services and development services.

CBRE was the first International Property Consultancy to set up an office in India in 1994. Since then, the operations have grown to include more than 10,000 professionals across 15 offices with a presence in over 80 cities in India. As a leading international property consultancy, CBRE provides clients with a wide range of real estate solutions, including Strategic Consulting, Valuations/Appraisals, Capital Markets, Agency Services, and Project Management. The guiding principle at CBRE is to provide strategic solutions that make real estate holdings more productive and economically efficient for its clients across all service lines. Please visit our website at https://www.cbre.co.in/

—-

English

English French

French German

German Italian

Italian