Shri Manoj Ahuja launches new campaign for banks underAgri Infra Fund titled Banks Heralding Accelerated Rural and Agriculture Transformation Campaign

Shri Manoj Ahuja, Secretary, Ministry of Agriculture & Farmers Welfare today launched a new campaign for banks under Agri Infra Fund titled BHARAT (Banks Heralding Accelerated Rural & Agriculture Transformation). This one month-long Campaign (from

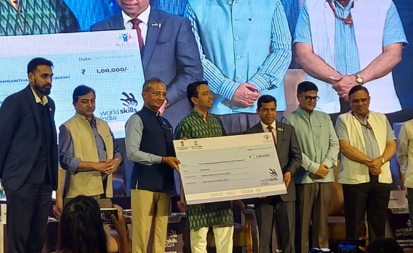

Shri Manoj Ahuja, Secretary, Ministry of Agriculture & Farmers Welfare today launched a new campaign for banks under Agri Infra Fund titled BHARAT (Banks Heralding Accelerated Rural & Agriculture Transformation). This one month-long Campaign (from 15th July 2023 to 15th August 2023) with a target of Rs 7200 crore was launched through Video Conference attended by more than 100 Banking Executives that included MDs/Chairman, EDs of commercial Banks in public and private sector, Regional Rural Banks, Small Finance Banks, NBFCs and select cooperative Banks. While addressing the gathering of Bank Executives and Ministry Officials Shri Samuel Praveen Kumar, Joint Secretary (AIF) highlighted the progress made since the inception of this ambitious flagship Scheme. In his welcome address, he complimented the Banks for their active involvement and support to promote this Scheme which has resulted in creation of more than 31, 850 agri infra projects in the country with ₹24750 crore as loan amount under AIF with an outlay of ₹ 42,000 crores.

Expressing satisfaction at the support from the MoA&FW and Project Monitoring Unit of AIF, participating executives from Banks came up with many suggestions to take AIF scheme to newer heights. Secretary, MoA&FW congratulated the top performing Banks in different categories, namely State Bank of India, Canara Bank, Punjab National Bank, HDFC, Kotak Mahindra Bank, Madhya Pradesh Gramin Bank, Madhyanchal Gramin Bank and Punjab Gramin Bank, for their laudable effort in contributing to take this scheme forward and appealed to all the Banks to achieve targets considering the vast potential for agri infra projects in our country. The Banks were also advised to carry out an assessment of impact of the projects created under the scheme at ground level.

—-

English

English French

French German

German Italian

Italian