Hotelivate Releases the 2024 Indian Hospitality Trends & Opportunities Report

09 October 2024: Hotelivate, a comprehensive hospitality consulting firm offering specialised services to clients across Asia Pacific and the Middle East, is proud to present the 27th edition of the Indian Hospitality Trends & Opportunities.

09 October 2024: Hotelivate, a comprehensive hospitality consulting firm offering specialised services to clients across Asia Pacific and the Middle East, is proud to present the 27th edition of the Indian Hospitality Trends & Opportunities. Report. The current participation base of 1,742 hotels with a total inventory of 1,80,403 rooms offers a comprehensive coverage of India’s branded hospitality landscape enabling better and more incisive analyses of national trends, performance of major hotel markets, and demand and supply forecasts than any other survey of a similar nature.

While the report offers a wealth of valuable insights, a few standout datapoints are particularly worth highlighting, providing deeper context and clarity on key trends and developments.

- 2023/24 saw occupancy rates surge, with Mumbai leading at 79.0%, closely followed by New Delhi at 78.7%, and Hyderabad at 75.1%, and almost match pre-pandemic levels.

- For the second consecutive year, Hyderabad recorded one of the highest RevPAR growths in the country, bolstered by a 26.2% rise in average rates.

- Indian-origin companies have a larger number of assets compared to their international counterparts, across India.

- Five-star Deluxe hotels stood out with an exceptional 147.4% increase in RevPAR over a 24-month period, the highest among all categories. Five-star hotels followed with a robust 131.0% growth, while Four-star hotels experienced a significant 99.3% rise.

- Hotels charging average rates of ₹7,500 or more have increased from 23% (354 hotels) in 2022/23 to 30% (517 hotels) in 2023/24.

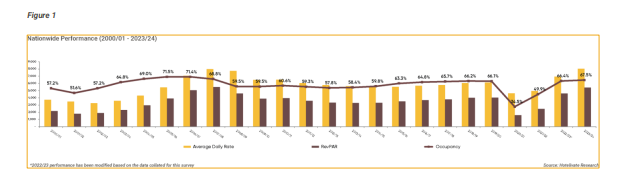

- As shown in figure Figure 1, the branded and organised hotel sector in India closed with a nationwide occupancy of 67.5% (the highest in a decade), with an ADR of ₹8,055 (the highest – EVER) and a consequent RevPAR of ₹5,439 (marginally shy of the lifetime high achieved in 2007/08).

- Despite slightly lower occupancy rates, Tier 3 cities surpassed Tier 2 cities in average rate, ₹6,829 and ₹6,682 respectively, driving higher RevPAR, attributed to a growing domestic presence.

The report provides an in-depth analysis of hospitality data from multiple perspectives. It also highlights key trends and opportunities for the industry in the coming year, offering a fresh outlook for the Indian hospitality sector. This year’s report introduces a new section on markets of interest, spotlighting several additional towns and cities beyond the top 20 markets that have attracted the attention of hotel developers and operators over the past year.

“It is remarkable that India’s hospitality sector is poised for significant growth, with an anticipated, unfiltered 49% increase in hotel room supply. Key markets such as Bengaluru, Mumbai, and Goa are leading this expansion, with 77% of the proposed supply currently in active development. This trend reflects a positive outlook for the industry, fuelled by rising tourism, business travel, and infrastructure improvements. As of March 2024, the overall branded pipeline for the next five years stands at 88,706 keys, regardless of construction status.”

Manav Thadani, Founder Chairman – Hotelivate

“The industry continues to perform well. With half of fiscal 2024/25 gone, there is overall growth over a phenomenal 2023/24 already, with the expectedly stronger winter months ahead. However, in most markets, growth has tapered, and in some it has indeed declined. Yes, the industry is still HOT. However, we strongly urge you to handle recent developments with the utmost care.”

Achin Khanna, Managing Partner – Strategic Advisory at Hotelivate

2023/24 shattered records, and 2024/25 is already demonstrating further growth compared to the previous fiscal year, at least on a blended, nationwide basis. The industry continues to promise stability and steady upward movement. However, it is essential to recognise that India is not a singular hotel market; measuring success with a broad-brush approach would be unwise. This year’s report highlights that nearly 300 markets—and thousands of micro-markets—constitute India’s hospitality landscape. As each market progresses toward varying levels of maturity, numerous variables influence their future success, necessitating a thorough analysis tailored to each market.

—–

English

English French

French German

German Italian

Italian