MakeMyTrip on “20% TCS on International Credit Card”

To be attributed to Mohit Kabra, Group CFO, MakeMyTrip “It is essential to maintain consistency of TCS across payment mechanisms. Bringing credit cards under TCS purview will ensure parity between debit and credit card payments. This

To be attributed to Mohit Kabra, Group CFO, MakeMyTrip

“It is essential to maintain consistency of TCS across payment mechanisms. Bringing credit cards under TCS purview will ensure parity between debit and credit card payments. This will also bring transactions done on global platforms under the TCS net as the customers’ card issuing bank will now be mandated to levy TCS on such transactions.

A customer can choose either domestic travel agents or a global OTA or book directly with an overseas service provider (such as a hotel) when it comes to international travel. If the upfront price and payment includes TCS for bookings made with domestic travel agents and its without TCS for bookings made on global platforms, there could be a significant loss of business for the domestic travel industry.

Why will this happen?

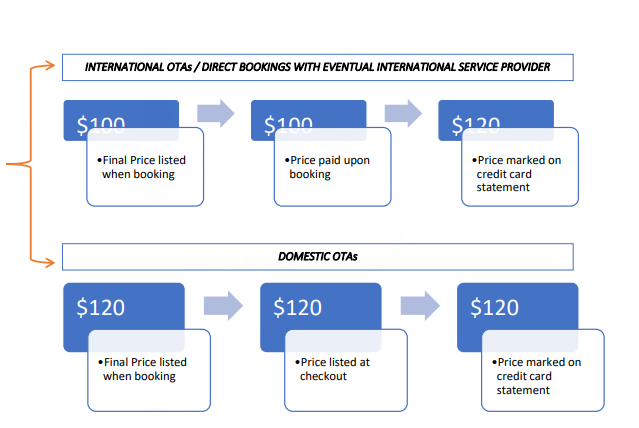

So far, domestic travel agents collect an extra 5% TCS from customers as they need to deposit this when remitting overseas suppliers. The foreign platforms remit monies to overseas suppliers from overseas locations, and hence if the customer had booked via credit card, the entire transaction escaped TCS. Effectively, while the domestic agents price the USD 100 package at USD 105 (taking 5% TCS into account), the international ones only price it at USD 100.

Even with credit cards being brought under the TCS net, the initial pricing of international platforms will remain untouched. The card issuing bank will be responsible for TCS for payments made via global platforms or directly to overseas travel service providers. So, if a USD 100 booking is made and paid on an international platform or with an international hotel directly, the customer will see the price as $100 and pay only $100 at the time of booking. TCS of USD 20 will be levied later by the customer’s card issuing bank.

However, when booking and paying with domestic travel agents, the customer will see a price of $120 and pay $120 under the current process. Domestic travel agents’ prices will appear to be more expensive to their international counterparts at face value / upfront.

Illustrative explanation of upfront price anomaly

Our Submission:

We request that the onus of collecting TCS be entirely on customers’ card-issuing bank at the time of payment through the card, irrespective of point-of-purchase – whether customers book or pay through domestic travel agents, overseas travel agents or even directly to the eventual overseas service provider. This will ensure a level playing field for domestic travel agents. In the above example the customer should be paying $100 on the platform where the booking and payment is made (domestic or international) and TCS of $20 should be levied by the Bank whose card has been used by the customer for payment.”

—-

English

English French

French German

German Italian

Italian